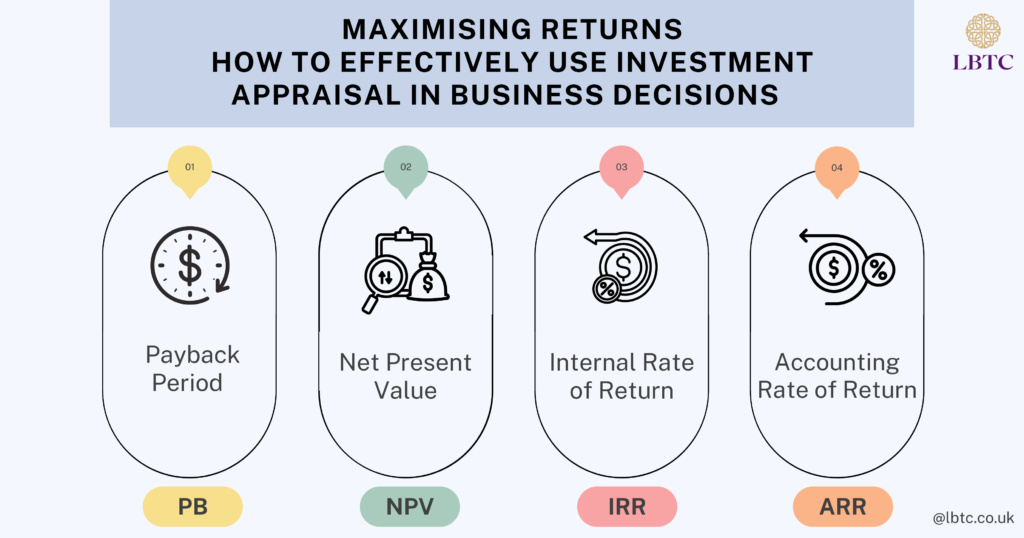

Before an organisation funds a new project or investment, it should think about the return on investment (ROI) and whether the capital will create gains or not. Investment appraisal is the evaluation of the expected profits, risks, and the total value of an investment opportunity or a project. Understanding these principles is often a key component of a management accounting course, which equips professionals with the skills to analyse financial data effectively. Investment appraisal helps the buyers to evaluate the projects and make smart choices to invest, which increases the value of the firm. This blog explains the essential practices such as Payback Period, Net Present Value (NPV), Internal Rate of Return (IRR) and Accountancy Rate of Return (ARR).

Types of Investment Appraisal Methods

Investment appraisal methods are vital tools for businesses to assess the viability of projects. Each method offers a unique perspective on potential returns.

1. Payback Period

The Payback period is the simplest investment appraisal in the market. This method explains about the amount of time taken by an investment to recovers its initial investment and to meet the breakeven.

Business Professionals will follow this approach because of its simplicity. Executives with basic knowledge of financial training can use and implement this method effectively.

Pro’s:

- Liquidity Focus: Focuses on how the investment will turn into cash in a short time, especially during risk management and liquidity.

Con’s:

- Ignores Profitability: This method mainly focuses on recovery but doesn’t aim for profitability.

Example:

For a project investment worth 10,000 which yields 2500 every year, the payback period is 4 years (10,000÷2500). After 4 years, the initial spent is recovered.

2. Net Present Value (NPV)

Net Present Value (NPV) measures the profitability of an investment by comparing the present value of cash inflows to the cash outflows. Understanding how to calculate NPV and other investment appraisal techniques is often a core part of a management accounting course.

Investing cash flows must be discounted to current value through a specific rate using capital cost or return. If NPV is positive, it means projected earnings will surpass anticipated costs, indicating that the project is favourable.

Pro’s:

- Clear Profitability Indicator: A positive NPV means the investment will be profitable. A negative one indicates the contrary.

Con’s:

- Requires Accurate Forecasting: Based on an accurate projection of cash inflows and an adequate discount rate.

3. Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) holds great importance in the context of investment appraisal. Further, it is defined as the rate which makes the Net Present Value (NPV) of the investment equal to zero. Therefore, IRR provides a metric to assess the profitability of prospective investments.

Usually, Businesses and even Investors determine if a project will make a good investment based on if its IRR value stands above the determined required return rate. Stronger IRR means better investment prospects and therefore allows easier decision making to fund the projects with higher expected growth.

Pro’s:

- Beneficial for Rankings: Helps prioritise among multiple projects with greater IRR than others.

Con’s:

- Multiple IRRS: Multiple IRRS can be generated because of non-conventional cash flows, which can prove to be problematic.

4. Accounting Rate of Return (ARR)

The Accounting Rate of Return (ARR) is a simple “straight-line” method of measuring the effectiveness of company investments. It determines the expected return from an investment in relation to the corresponding cost.

ARR is defined as the average annual profit divided by the initial investment amount. This results in a percentage that reflects how effectively capital can be utilised over time.

Pro’s:

- Ease of Calculation: The method is simple and uses financial data that is easily accessible.

Con’s:

- No Time Value of Money: Ignores the timing of cash inflows and outflows.

Conclusion

Ultimately, choosing the right ‘investment appraisal method’ is very important to the strategic financial decision. Simple techniques such as Payback Period may focus solely on liquidity, but they neglect the critical profitability aspects. Expected profitability is clearly measured by NPV, but accurate cash flow estimations and complicated calculations are needed. IRR does help rank projects by order of expected returns; however, it has interpretive difficulties when it comes to multiple IRR’s. If ARR does provide an estimate of profitability, it is simple; however, it overlooks the time value of money and is easily manipulated. Overall, the need to invest appropriately often requires an all-encompassing analysis using several methods to strike a balance between precision, ease of application, and strategic alignment, all this while ensuring that the organisation values and grows. Incorporating management accounting course principles helps decision makers quickly gauge potential investment returns.

Leave a Reply